With the growing number of students travelling for quality education, demand for student housing is growing every year.

While in many countries students can also rent residential apartments or stay as guests as is this case with exchange programmes, the industry we are referring to specifically caters to purpose-built student accommodation or PBSA

ROD FAMILY OFFICE

Family Office Valuations

Student accommodation is generating significant demand amongst investors due to its steady relatively low-risk income.

Given the steady incomes of stabilized facilities, the capitalization rate approach or a comparable approach are commonly used valuation approaches.

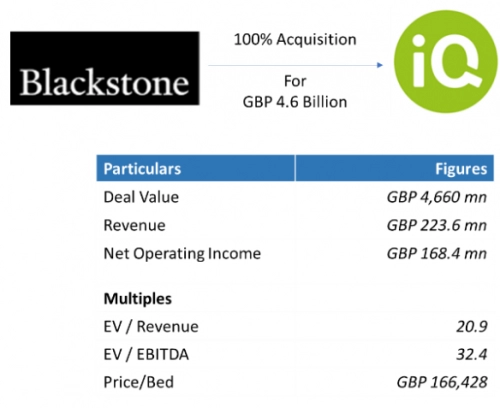

IQ Student accommodation or IQ is the largest student accommodation provider in the United Kingdom with over 28,000 beds.

With an occupancy of 97%, it generated revenues of 223 million pounds and a Net Operating margin of 76.4% in 2019.

In Feb 2020, Blackstone, one of the world’s largest property dedicated investment firms offered 4.6 billion pounds to acquire IQ student accommodation.

This is the largest student housing transaction globally.

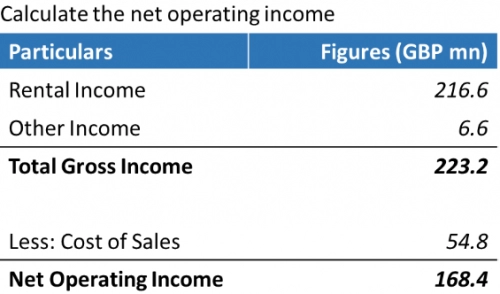

To understand how Blackstone valued IQ at 4.6bn, we utilize the cap rate approach. Firstly, from annual filing, we calculate the annual net operating income of the business

Next, we apply the appropriate cap rate for said properties. In the pie chart, we see that IQ’s facilities are majorly concentrated in London with a balance of 48% spread across other key Russell group cities

Using market cap rates we estimate the effective cap rate for the entire property portfolio of IQ as 4.1%. Applying the derived values we get a valuation of 4.1 million pounds.

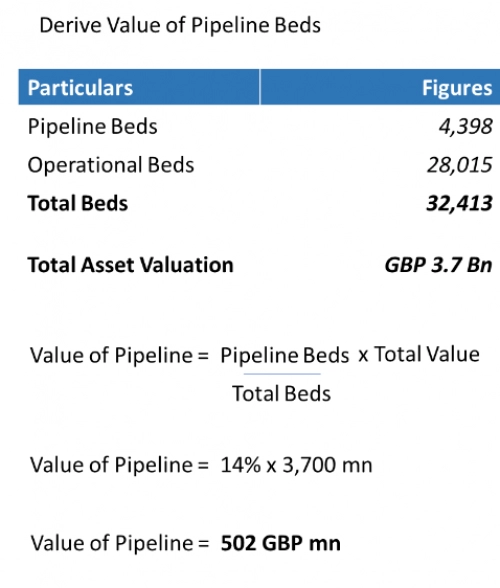

This seems off from the announced transaction value, but keep in mind this is only for the portfolio of 28,015 beds. IQ also has 4 thousand beds under development which are not yielding income today. At the time of the transaction, 4,328 were under development.

We can assume the value of these non-operational beds as their asset values. Proportionately, we value the pipeline at 502 million pounds.

Adding both values we get approximately 4.6 bn which is in line with the announced deal value.

Specialists for every situation

Rodschinson Investment is your trusted investement partner to make the smartest possible move whatever is your current situation.

Bastion Tower (level 11-12)

5, Place du Champ de Mars

1050 Brussels, Belgium